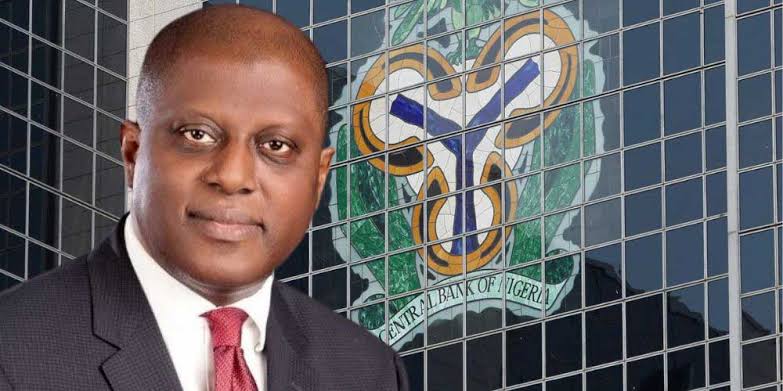

The Governor of the Central Bank of Nigeria, Olayemi Cardoso, has revealed that the bank has stopped giving Ways and Means to the Federal Government.

Cardoso, who spoke in Abuja, said until the previous loans are repaid, no more would be given out.

He said this during a meeting of the Economic Team with the Senate Committees on Finance, Appropriations, Banking, Insurance and Other Financial Institutions.

He said this was one of the measures taken by the apex bank to curtail the economic challenges currently facing the country.

Cardoso said: “On our side at the CBN, we have responded with significant monetary policy tightening to reign in inflationary pressure.

“Empirical analysis has established that money supply is one of the factors fueling the current inflationary pressure.

“For instance, an analysis of the trend of the money supply spanning over nine months shows that M3 increased from N52.01 trillion in January 2023 to N68.25 trillion in November 2023, representing N16.24 trillion or 31.22 percent increase over the period.

“Increase in Net Foreign Asset following the harmonisation of exchange rates and the N3.22 trillion ways and means advances were the major factors driving the increase in money supply.

“I am pleased to note the Fiscal Authorities efforts in discontinuing Ways and Means advances.

“This is also in compliance with Section (38) of the CBN Act (2007), the Bank is no longer at liberty to grant further Ways and Means advances to the Federal Government until the outstanding balance as of December 31, 2023 is fully settled.

“The bank must strictly adhere to the law limiting advances under ways and means to five percent of the previous year’s revenue.

“We have also halted quasi-fiscal measures of over N10 trillion by the Central Bank of Nigeria under the guise of development finance interventions which hitherto contributed to flooding excess Naira and raising prices to the levels of Inflation we are grappling with today.

“The CBN’s adoption of the inflation-targeting framework involves clear communication and collaboration with fiscal authorities to achieve price stability, potentially leading to lowered policy rates, stimulating investment, and creating job opportunities.

“Our MPC meeting on the 26th and 27th of February is also expected to review the situation and take further decisions on these important issues.

“Distinguished Senators, inflationary pressures are expected to decline in 2024 due to the CBN’s inflation-targeting policy, aiming to rein in inflation to 21.4 percent in the medium term, aided by improved agricultural productivity and easing global supply chain pressures.

“Distinguished Senators, these measures, aimed at ensuring a more market-oriented mechanism for exchange rate determination, will boost foreign exchange inflows, stabilise the exchange rate, and minimise its pass-through to domestic inflation.

“Indeed, they have already started yielding early results with significant interest from Foreign Portfolio Investors that have already begun to supply the much-needed foreign exchange to the economy.

“For example, upwards of $1 billion in the last few days came in to subscribe to the Nigeria Treasury Bill auction of N1 trillion, which saw an oversubscription earlier this week.

“Our measures aimed at improving USD supply into the Nigerian economy, have significant potential in taming the volatility of the exchange rates.

“However, for these measures to be sustainable, we must as a country, moderate our demand for FX.”